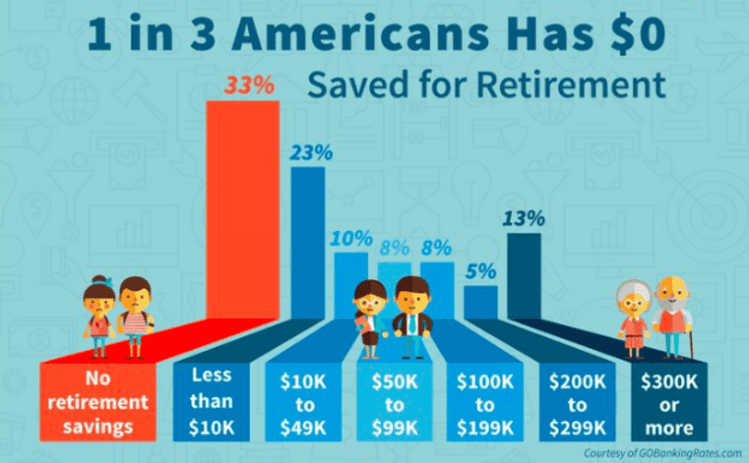

With Americans’ documented lack of retirement savings, it’s no surprise that most people are planning to work past 62, the […]

Insights

The Retirement Crisis Is Already Here

The concept of retirement has changed dramatically in the decades since the introduction of the 401(k), which has transformed the […]

Insights

3 Reasons Why Plan Participants Aren’t Contributing to 401ks

Everyone knows how important it is to have a retirement savings strategy. But because our brains are wired to make […]

Insights

Is Financial Wellness the Solution to the Retirement Crisis?

In another post, we examined the history of the 401(k) and how it came to dominate retirement planning. In this […]

Insights

A Short History of the 401(K), or the Death of the Pension Plan

The legislative debate during the passage of the new tax reform law about how 401(k)s would be affected caused jitters […]

Insights

9 Essential Questions For Protecting Your Retirement, Answered

When’s the best time to plan for retirement? It depends–there’s no one size fits all approach, and everyone’s individual situation […]