The legislative debate during the passage of the new tax reform law about how 401(k)s would be affected caused jitters to retirement planners and financial advisors across the US. Many experts believe that giving employees any less incentive to save for retirement could exacerbate an already bleak scenario faced by most Americans. To understand the how and why of our national retirement crisis, let’s review a little history.

Once upon a time, people went to work for a company knowing that after spending 20 or 30 years there, they could retire with a monthly pension check from their former employer. From 1940 to 1960, the number of people covered by private pensions increased more than 5 times over, from 3.7 million to 19 million, covering 30 percent of the labor force. By 1975, 103,346 private pensions, AKA defined benefit (DB) plans into which the employer pays, covered 40 million people. But during the following 20 years, these numbers dropped precipitously. By 1998, defined contribution plans, into which the employee paid and the employer might or might not contribute, made up the vast majority of private retirement plans—92.3%. What happened?

First, the Studebaker Company, which had been teetering on the brink of bankruptcy for several years, closed its South Bend, Indiana plant in 1963. Its pension plan imploded and the company became a symbol of the need for pension reform.

Congress stepped in and passed the Employee Retirement Income Security Act of 1974, or ERISA. ERISA sets minimum standards for employer retirement plans, mandates that the plan operate to benefit employees and their beneficiaries rather than the plan administrator or associates, and leaves the employer liable should they fail to meet their fiduciary responsibilities—they can be sued for restitution. Employers now had more responsibility for managing their pension funds.

Then, Congress passed the Revenue Act of 1978. It included a provision, section 401(k), that allowed employees to defer taxes from bonuses and stock options. A year later, benefits consultant Ted Benna of the Johnson Companies realized that this provision could be used to create a tax-deferred employee savings account for one of his clients, to lower taxes paid on the employees’ annual bonus. But he was concerned that employees would feel negatively about not being able to immediately access the cash.

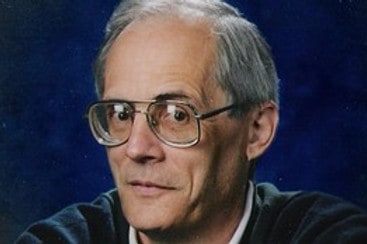

Ted Benna, the ‘father of the 401(k)’. Photo credit: Ted Benna

As Benna tells it:

“It was in fact a bit of desperation that got the creative juices flowing. I could use this section to design a plan allowing each employee to put into the plan whatever portion of the cash bonus he or she wanted. The only catch was that I had to get the lower-paid two thirds to put enough money into the plan to allow the top one third to contribute as much as they wanted.

Employees who put money into the plan would get a tax break but I knew this wouldn’t be enough to get many of the lower-paid employees to put money into the plan. This is when I thought of adding a matching employer contribution as an additional incentive. I was reasonably confident I could get favorable results through the combined incentive of a tax break plus an employer matching contribution.

It was at this point when the potential of what I had just “created” hit. Most large employers had savings plans at the time where employees put money in after-tax and received a matching employer contribution. The Johnson Companies has such a plan. I immediately realized it would be possible to change all these plans so that employees would be able to put their money in pre-tax rather than after-tax.”

The client rejected the first ever 401(k) plan. Their attorney didn’t want them doing something that had never been done before and was concerned that once the government realized the tax loss potential of the plan, the 401(k) provision would be repealed. After the client turned it down, Benna persuaded his own company to use it. When the IRS issued favorable rulings in 1981, employer adoption of the new 401(k) plans took off. And much of the risk associated with planning and investing for retirement shifted from employers to employees.

Ted Benna never imagined that the 401(k) would replace pensions and become the primary vehicle that so many Americans would use to save for retirement. He, along with other early promoters of the 401(k), originally envisioned it as a supplement to company pensions, not a wholesale replacement. The 401(k) was never intended by its creators to be workers’ primary means of income replacement in retirement.

Instead of being able to count on a pension that guaranteed a known income during the rest of one’s life, workers are now responsible for choosing their own investments and are more vulnerable to the vagaries of the stock market. So, what can employers, workers, and retirement planners do to address this problem? The concept of financial wellness is one answer.