In another post, we examined the history of the 401(k) and how it came to dominate retirement planning. In this post, we’ll explore how financial wellness offers one solution to saving more for retirement—and hope for improving employees’ overall financial health.

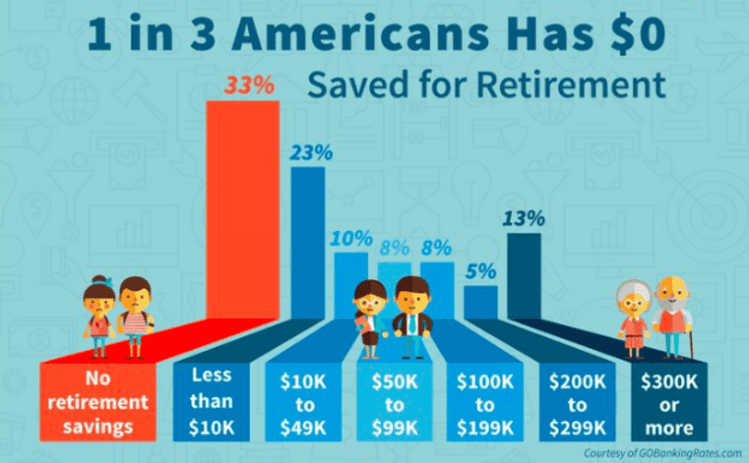

When we look at the data, the 401(k) hasn’t worked very well to help most people save for retirement. In fact, Americans are currently facing a retirement crisis. In spite of the high average levels of retirement confidence reported in national surveys, one out of three of Americans has saved nothing for retirement. Zero. Zip. Nada. According to a national report, 56% of employees have less than $10,000 saved.

And the numbers on the average amount of retirement savings can paint a misleading picture. Calculating just the average can mask the stark divide between a smaller number of retirement ‘haves’ and the much larger number of retirement‘ have-nots’. A small percentage of high earners, roughly 20%, who have saved large amounts of money combined with the 80% of lower-income workers who have saved relatively little tends to paint an overly optimistic picture of the country’s retirement preparedness. The median, which calculates the midpoint of a range so that half the participants are above the midpoint and the other half are below the midpoint, is a much more realistic measure when the data are so unevenly distributed.

The Employee Benefit Research Institute reports that in 2015, the median balance in 401(k) accounts nationally was only $18,433. Even combined with Social Security, that amount would hardly last over the course of a 20- to 30-year retirement. And the Economic Policy Institute (EPI) paints an even grimmer picture. Analyzing US Census data, the EPI calculates that in 2014, less than one in 10 seniors received retirement account distributions, and the median amount was $5,400.

So what’s the problem? While there are multiple factors at work, one key reason is this: thinking of retirement planning solely in terms of the 401(k). Retirement planning needs to take a more holistic view, and addressing financial wellness needs to come first. People simply can’t save for retirement when they have large amounts of consumer, auto, or student debt and are living paycheck to paycheck, just barely keeping up with their current bills, and without any emergency fund.

Financial wellness is much more than a nice add-on to retirement plan advising. Genuine financial wellness gets people back on track financially so they can pay down debt and have short term savings for emergencies, so that they don’t have to borrow. Then they can afford to save for retirement adequately. The key to an effective financial wellness solution is that it offers a comprehensive picture of a person’s financial situation, and focuses on changing behaviors. Financial wellness can be a key component of a total benefits plan, and more than just a buzzword.

Employers are realizing the advantages of having a financially healthy workforce: more productivity and less absenteeism from not being distracted on the job by financial worries, and lower stress-related healthcare costs. And that’s not the only reason more employers are thinking comprehensively about financial wellness as part of a total benefits package. With half of employees feeling stressed out over their financial situation, providing financial wellness is another way to attract and retain workers at a time when unemployment numbers are hitting record lows. A new report estimates that 91% of employers plan to develop or expand their financial wellness offerings in 2018 beyond their current retirement plan offerings.

Financial wellness may not be the end all be all when it comes to the retirement crisis facing Americans, but changing the way we think about retirement planning, overall financial health, and financial education is a critical first step. The challenge will be for policymakers, employers, and retirement planning experts to start thinking differently about the 401(k). It is clear that it should no longer be the centerpiece of retirement planning that it has been. Indeed, it was never supposed to be what it has become. Comprehensive financial wellness programs offer tailored approaches, systems, and resources to help employees get in control of their finances sooner as well as later. After all, it’s hard to have a happy life at any age if you’re worrying about money all the time.