It’s the speed and coverage of their connections that we’re most excited about.” – John M. Tabb III, co-founder and chief product officer, Questis

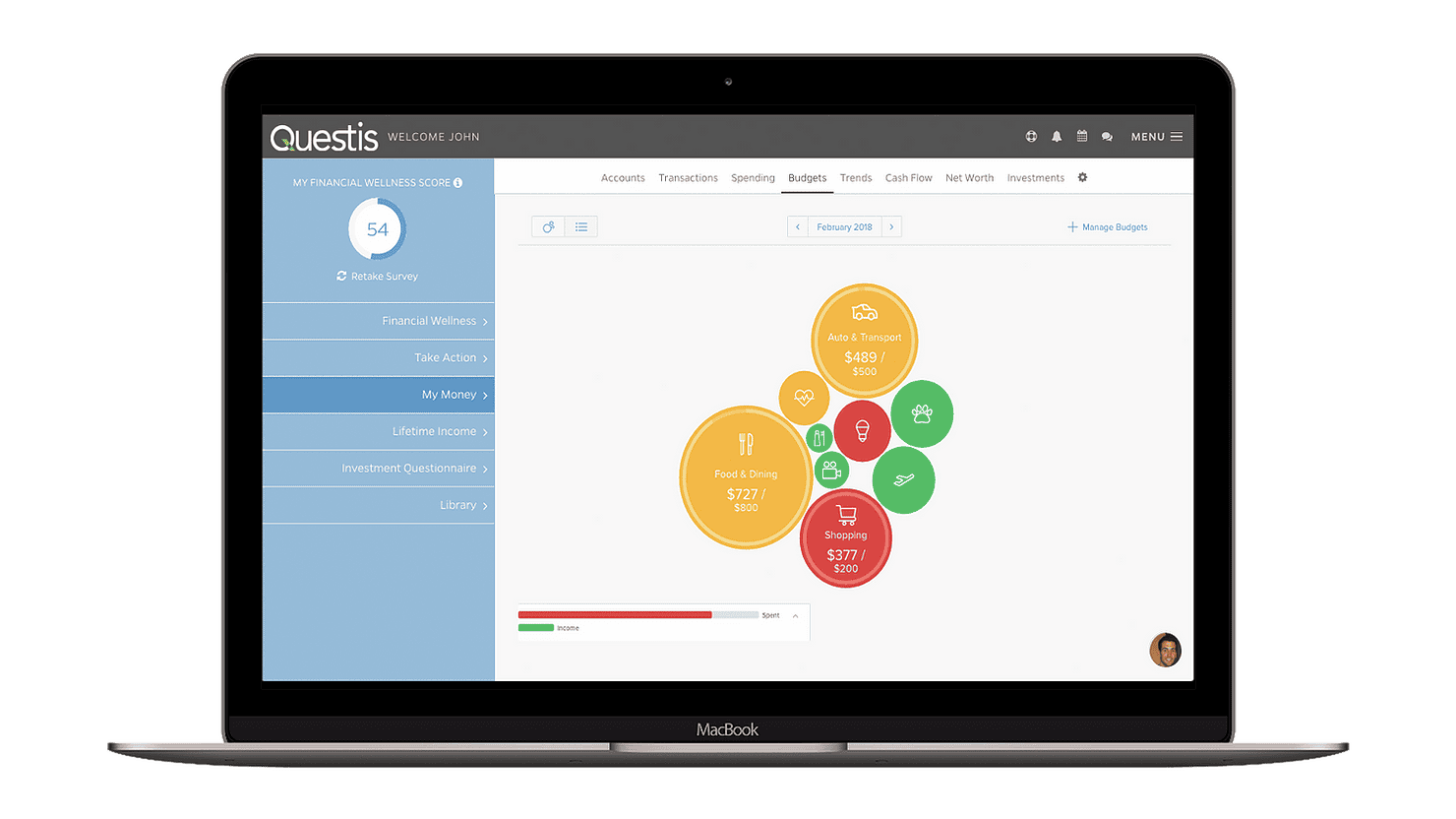

Questis is excited to announce our switch to MX, the leader in financial data, for our financial wellness technology platform data aggregation needs. With MX, participants using the Questis platform can see all of their finances in one place in a clear, organized, visual manner.

“MX gives our Questis customers a much clearer and more holistic view of their financial health than ever before,” said John M. Tabb III, co-founder and chief product officer at Questis. “Success for us begins with quality data and well-planned integrations with the most secure connections possible. It culminates with world-class customer engagement. These are major strengths of MX and are why we’re so glad to be working with them.”

Questis’ tools for retirement advisors allow participants to build and stick to action-oriented plans personalized just for them. This new clarity can be used to track spending, build budgets, create and track goals, and identify areas of risk (e.g. investment allocation). For each task or goal, Questis utilizes data from multiple sources in which the speed of connection is paramount to success.

“Unlike other vendors, MX offers redundant connections with multiple data providers – which means that alternative connections are available after a connection failure occurs,” continued Tabb. “With MX, account holders do not have to wait for a new connection to be coded. New connections are often made available quickly after MX becomes aware. It’s the speed and coverage of their connections that we’re most excited about.”

The level of security provided by MX, well known for protecting and securing customer data, was an important decision point for Questis. The MX security program is supported by a comprehensive suite built on confidentiality and privacy policies, along with best-in-class processes, procedures, and controls.

“We love the MX vision of building financially strong citizens through data-driven advocacy,” said Tabb. “They believe in changing people’s financial habits to ultimately empower everyone to become financially stronger. We agree wholly and are proud to have a partner with a vision so seamlessly aligned with ours.”

About MX

MX, the leader in financial data, enables financial institutions and technology providers to aggregate, enhance, analyze, present and act on data⎯empowering the world to become financially strong. Founded in 2010, MX is one of the fastest-growing fintech providers, partnering with more than 1,800 financial institutions and 43 of the top 50 digital banking providers. For more information, visit www.mx.com.