Constructing a great employee benefits package can have a tremendously positive influence on current and prospective employees. Likewise, it makes the difference between a good and a great company.

In today’s competitive climate, businesses need to stay on top of their offers. In fact, perks and benefits have a ripple effect on recruitment strategy, turnover, and budgeting. It can cost up to $18,000 to fill a minimum wage level position due to employee turnover. The cost can be up to two times the salary at upper management positions, and it takes six months to recoup costs.

And with the great resignation on employers’ doorstep this year, the retention rate became a signal of success. The high level of retention is an indicator of healthy company culture and a great benefits package. However, the financial strain of the pandemic changed the rules, and financial wellness now has a central role in the employee benefits package.

According to the Shortlister wellness trends report for 2021, financial wellness programs grew in popularity in the years before the pandemic. Still, they had a rapidly accelerated growth over the past year. The new state of the world made it obvious for both employees and employers that having your finances in order is crucial for optimal living. Thus, it made perfect sense for Questis to partner with Shortlister.

Questis’ Role in the Employee Benefit Package

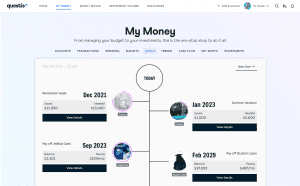

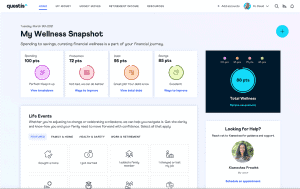

Questis is about financial empowerment or, more accurately, about helping people create a productive relationship with money, which has the potential to affect every aspect of their life. By using the power of behavioral science, custom-tailored and targeted solutions, and personalized one-on-one financial coaching, Questis can help both companies and individuals to start their financial wellness journey.

According to the Harvard Business Review, financial wellness is a crucial step towards financial stability, and employers all over the U.S. are starting to offer the benefit. In fact, when employers make employee-driven decisions, they begin to provide choices like:

- Financial Educational Materials

- Financial Coaching,

- Budget management tools,

- Integrated financial and retirement planning.

Questis offers businesses and individuals all these features and more as a state-of-the-art financial empowerment tool.

- Consistent and compassionate support for groups and individuals,

- Accessible and personalized financial planning,

- Software that includes custom reporting, data analytics, and trends.

Questis is the product of a cross-disciplinary team of financial advisors, tech leaders, and business visionaries that combined FinTech and coaching and made it easy for employers to take care of their employees.

The Shortlister Verified Badge

The “Shortlister Verified” badge lets employers and consultants know that Shortlister validated the solutions that Questis offers. Moreover, the badge itself means that Shortlister vetted the company and fulfilled all the criteria for a top vendor.

In short, it’s a vote of confidence from the Shortlister team.

It shows that Questis has gone through the thorough vetting process required for enrollment and activation on the platform.

Shortlister Top Vendor

Shortlister uses a wide range of criteria to determine the top vendors in each category, including benchmarks and business practices. Hence, the top vendor badge provides employers, consultants, HR teams, and employees with a clear recommendation about the company’s quality.

Questis was chosen as a top vendor for two supplementary categories for Q4 2021:

- Financial Wellness Programs

- Financial Coaching

To be a Shortlister top vendor means Questis is one of the best companies on the platform for financial wellness and an excellent choice for any employer shopping for these services.

The Significance of Financial Wellness

In a nutshell, financial wellness is about economic healing and empowerment. According to the 2021 PwC Employee Financial Wellness Survey, 63% of employees say their financial stress has increased since the start of the pandemic, and 72% are millennials, the largest group in the labor market.

In a nutshell, financial wellness is about economic healing and empowerment. According to the 2021 PwC Employee Financial Wellness Survey, 63% of employees say their financial stress has increased since the start of the pandemic, and 72% are millennials, the largest group in the labor market.

These statistics speak volumes about the state of society and the dire need for financial education and literacy.

Therefore, working with a company that not only understands but elevates the field of financial wellness is a crucial step in the right direction for employers. It might be as simple as coaching and educating employees about budgeting or 401k, but the benefits and the potential for positive change are enormous.

As a high-level employee retention strategy, financial wellness helps employers lower turnover costs and rewards them with higher engagement levels. It’s used for talent acquisition by recruiters and as a tool for greater employee satisfaction.

However, the first step towards financial sustainability is adding financial wellness programs to the benefits package and making them accessible. And that’s the main goal of Questis.

Like what you see? Log in to your Questis account for more articles like this one!

Don’t have access to Questis yet? Tell your employer about us!